year end tax planning letter 2021

While it is said history does not repeat itself sometimes its events are awfully similar. Use this year-end tax planning letter to get the conversations started with your.

Accountancy Flyer Diy Canva Accountancy Flyer Template Etsy In 2022 Flyer Template Flyer Templates

As a client of RMS Accounting we are pleased to offer you a FREE year-end tax planning appointment.

. Time is ticking on year-end tax planning as 2021 draws to a close. Challenges remain at the end of 2021 as the country is still recovering from the pandemic and the fate of the Build Back Better Act BBB is uncertain. In what appears to be the new normal 2021 is shaping up to be a year with plenty of tax law changes.

Before we get into particular recommendations keep in mind that good tax preparation necessitates at the very least. Thats right as long as we prepared your 2020 tax return your tax planning. The credit expires December 31 2021.

As of late October major tax changes from recent years generally remain in place including lower income tax rates larger standard deductions limited itemized deductions. And 3 regular depreciation. 2021 Year-End Tax Planning.

BUSINESS TAX PLANNING. Parker Tax Publishing November 10 2021 The coronavirus pandemic COVID-19 continued to impact businesses in 2021. 1 the Section 179 deduction.

Make sure that qualified property is placed in service before the end of the year. Changes in legislation allow businesses to qualify for both Paycheck Protection Program PPP loans and the ERC. 2021 Tax Planning Letter.

The following includes several tax planning opportunities for you. At year-end a business may secure one or more of three depreciation-related tax breaks. 2021 Year-End Tax Planning Letters for Businesses and Individuals.

The information contained herein is based on tax. Dear Clients With year-end approaching it is time to start thinking about moves that may help lower your tax bill for this year and next. This letter discusses some options available to help minimize your 2020 tax bill and plan for the years.

Now ARPA authorizes a maxi mum cr edit of 21000 per worker for 2021 with eligible wages ending on September 30 2021. Dear Clients and Friends With the end of the year approaching it is a good time to review your 2021 income tax situation and take steps to ensure that you are taking full advantage of the many tax planning strategies available. 2021 Tax Planning Letter Individuals.

As many of the tax breaks legislators provided during the pandemic come to an end and many uncertainties surround the Biden Administrations future on taxes it is important to stay informed and plan for 2022 and. Dear Clients and Friends With the end of the year approaching it is a good time to review your 2021 income tax situation and take steps to ensure that you are taking full advantage of the many tax planning strategies available. 2020 was a tumultuous year due to Covid-19.

BMSS 2021 Year-end Tax Planning Letter 2021 has been a year filled with recovery from the pandemic and economic hardships of 2020. 2021 year-end tax letter. Due to these election uncertainties it will be extremely difficult for taxpayers and professional advisors to anticipate possible tax changes for 2021.

Fast Reliable Answers. In the fall of 2017 it was unclear whether the Tax Cuts and Jobs Act TCJA would be enacted. Leading Federal Tax Law Reference Guides.

In contrast one of our tax returns has been returned by the. 2 first-year bonus depreciation. With the end of the year approaching now is a good time to assess your 2021 income tax status and make sure youre taking advantage of all of the available tax preparation methods.

2021 Year-end Tax Planning Letter To Our Clients and Friends. As we approach year-end its time to think about steps you can take to help reduce your 2021 tax bill. An In-Depth Look.

Lucy Luo CPA. Finally in Notice 2021-15 and Notice 2021-26 the IRS clarified that DCAP benefits that would have been excluded from income if used during the tax year ending in 2020 or 2021 as applicable remain eligible for exclusion from the participants gross income and are disregarded for purposes of applying the limits for the subsequent tax years of the employee when they are. 2020 YEAR-END TA PLANNING WHITINGERCOM.

Download Our 2021 Year-End Tax Planning Letter. As we write this years tax letter we are reminded of our 2017 edition. Tax advisers face the difficult task of helping clients plan for next year while there are lots of unknowns.

2021 YEAR END TAX PLANNING LETTER. The legislative response to COVID-19 resulted in significant tax law changes for 2020 and 2021. In December of 2020 and March of 2021 COVID-19 relief provisions were enacted in the Consolidated Appropriations Act 2021 CAA 2021 and the.

Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. This years planning is more challenging than usual due to the uncertainty surrounding pending legislation that could increase corporate tax rates plus the top rates on both business. Go Back Print.

2021 Tax Planning Letter Businesses. 8 rows Keeping all that in mind we have prepared the following 2021 Year-End Tax Letter. Get Access to the Largest Online Library of Legal Forms for Any State.

For the first time in 40 years taxes on income and wealth transfers may be headed higher making tax planning more important than ever. With year-end approaching it is time to start thinking about moves that may help lower your businesss taxes for this year and next. Ad Offers Comprehensive Explanations Of Topics Often Researched By Tax Professionals.

In 2020 from our internal surveys 81 of self-prepared returns had errors and over 62 of other tax preparers returns had mistakes. Before we get to specific suggestions keep in mind effective tax planning. 2021 year-end financial planning letter Use this year-end financial planning letter as a handy list of topics to cover with clients as the end of year approaches.

This years planning is more challenging than usual due to the uncertainty surrounding pending legislation that could among other things increase top rates on both ordinary income and capital gain starting next. This Tax Planning Letter includes updating you on things you should know and consider doing before the end of 2020 to save on taxes and some ideas for 2021. The ERC is a refundable payroll tax credit that may be claimed by eligible employers whose business has been financially impacted by COVID-19 when paying qualified wages to qualifying employees.

In addition ARPA allows businesses that started up after February 15 2020 and have an average of 1 million or less in gross receipts to claim a credit of up to 50000 per quarter. The end of the year is in sight and as 2021 wraps with legislation still under construction tax planning knowledge for yourself and your business will be essential for 2022. Nate Miller CPA MST.

2021 Year-End Tax Planning for Businesses. Like everything else in 2021 year-end tax planning wont be status quo due to the uncertainties of a continued global pandemic and complicated and ever-changing tax laws. Finally in Notice 2021-15 and Notice 2021-26 the IRS clarified that DCAP benefits that would have been excluded from income if used during the tax year ending in 2020 or 2021 as applicable remain eligible for exclusion from the participants gross income and are disregarded for purposes of applying the limits for the subsequent tax years of the employee when they are.

2021 planning year end tax. Personal Financial Planning Tax Investment Planning Retirement Planning Tax Planning Tax Policy Regulatory Change. Regardless of uncertainty year-end tax planning opportunities should still be explored.

Greetings Clients and Friends.

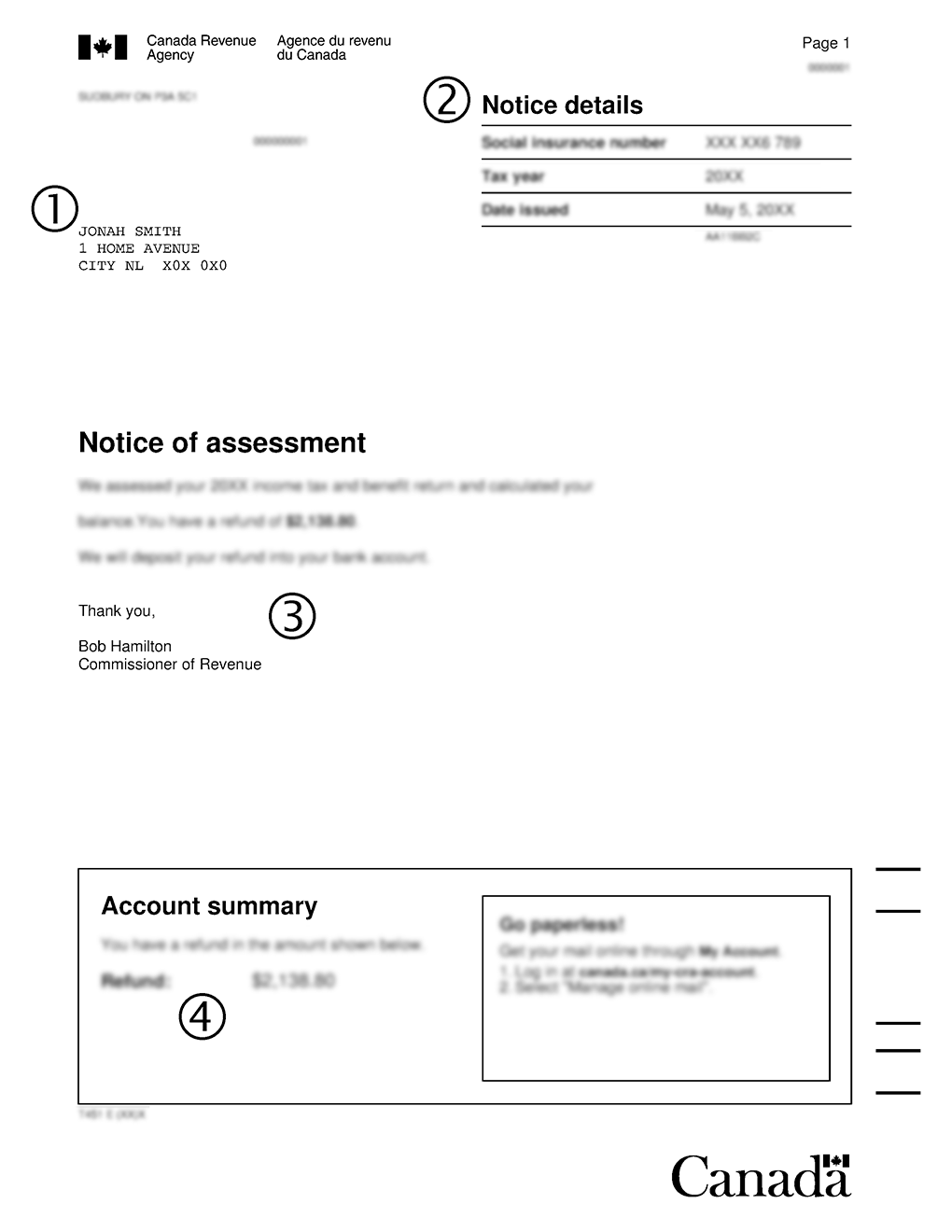

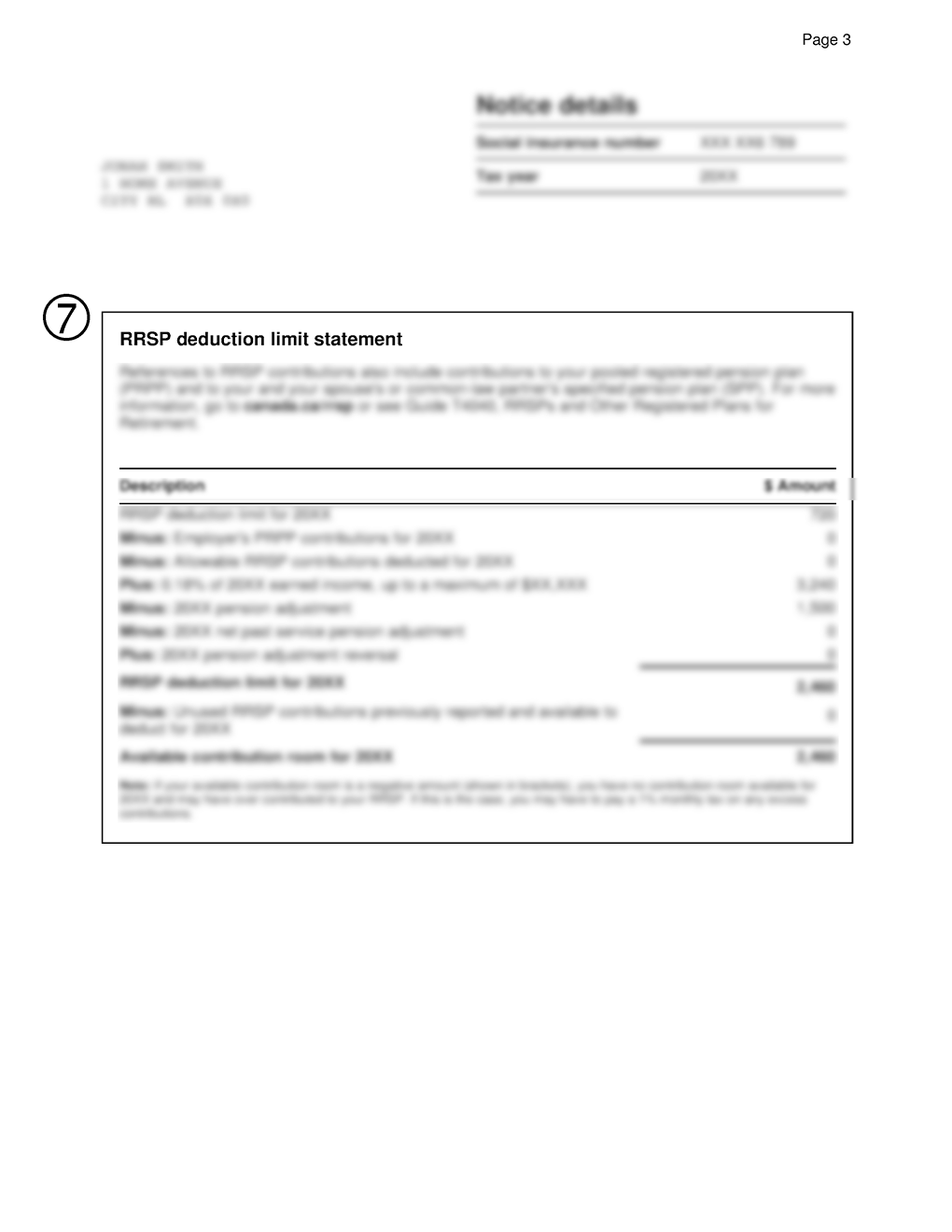

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

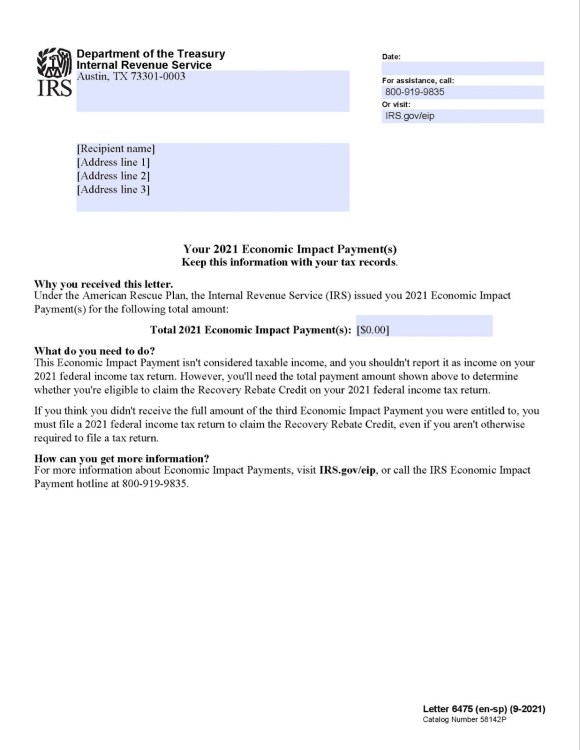

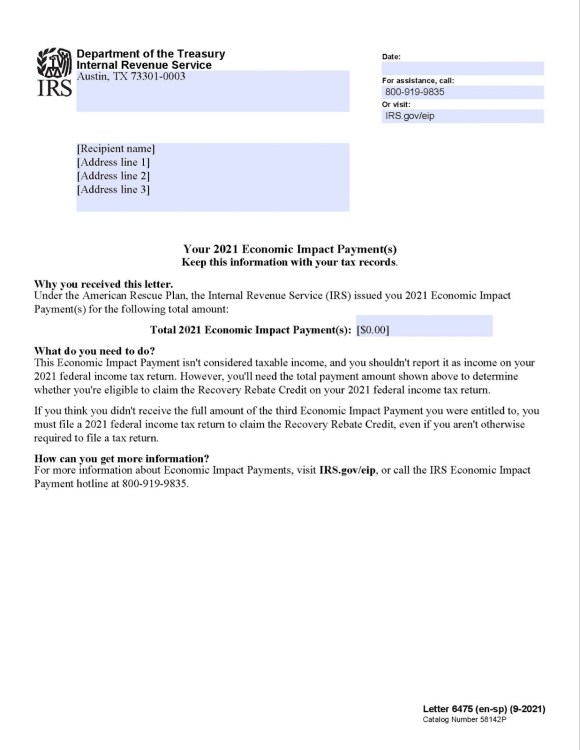

Irs Letters 6419 And 6475 For The Advance Child Tax Credit And Third Stimulus What You Need To Know The Turbotax Blog

Editable Class Agent Handbook 20132014 By Suffield Academy Issuu Alumni Fundraising Letter W Fundraising Letter Lettering Solicitation Letter

Free Termination Letter Template Introduction Letter Letter Templates Lettering

Guide To Small Business Owners And Freelancers On How To File And Settle Income Tax In The Philippines Income Tax Income Income Tax Return

Ppi Claim Letter Template For Credit Card Best Business Intended For Ppi Claim Form Template Letter In 2022 Lettering Letter Templates Business Letter Template

Best Administrative Assistant Cover Letter Examples Livecareer Cv Lettre De Motivation Exemple De Lettre De Motivation Exemple De Lettre

Tax Director Resume Tax Manager Resume Becoming A Tax Manager Is A Vital Job To Applying For That You Must Manager Resume Accountant Resume Sample Resume

Business Letter Template Introduction Letter Lettering

Missing A Stimulus Check Irs Letter 6475 Can Help You Claim Recovery Rebate Credit On Taxes Usa Today In 2022 Lettering Irs How To Plan

Ein Tax Id Confirmation Letter Confirmation Letter Letter Template Word Lettering

Tax Deduction Letter Pdf Templates Jotform

Sponsorship Letter For Event Template Format Sample Example Sponsorship Letter Proposal Letter Event Sponsorship

Irs Letters 6419 And 6475 For The Advance Child Tax Credit And Third Stimulus What You Need To Know The Turbotax Blog

Pdf Tds Declaration Form 2021 22 Pdf Download Income Tax Declaration Career Development

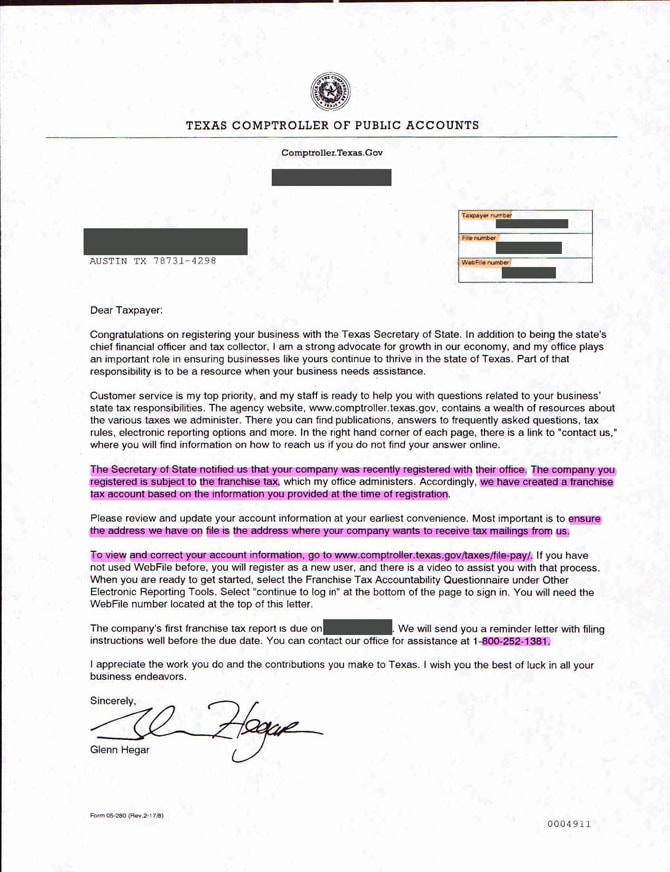

Texas Llc No Tax Due Public Information Report Llc University

Personal Statement Template Bank Statement Cash Flow Statement

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

Creative Resume Template Word Pages Cv Template Etsy Canada Executive Resume Template Resume Template Minimalist Resume Template